Forex Strategy

Explain for Sonic R System in Forex 2

Explain for Sonic R System in Forex 2

This is a trend following trading system. It is based on some indicators and there is a

template ready for you to download.

Indicators

Stealth LCD V10 default setting

QQE MTF

CCI indicator Period 63

34 EMA HIGH/CLOSE/LOW

50SMA

Trading time

1AM – 4 AM EST (UK session)

7AM – 11 AM EST (US session)

Pairs

I have tested: EURUSD, GBPUSD, USDCAD, EURJPY, GBP/JPY.

Timeframe (TF)

5M Timeframe

15M Timeframe (recommended)

Buy signal

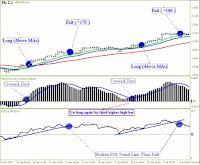

When v10 show blue color

When QQE is above 50 line

When CCI period 63 is above 0 line above +75 or above give safer signal

When the price is above 50 SMA.

And price is above the upper white line and the slope points up

Always wait until candle close and then place your order 5-7 pips above last closed

candle.

Stop Loss. I use 50sma as SL. So if price close below the 50 sma I close the trade.

See PIC.1

template ready for you to download.

Indicators

Stealth LCD V10 default setting

QQE MTF

CCI indicator Period 63

34 EMA HIGH/CLOSE/LOW

50SMA

Trading time

1AM – 4 AM EST (UK session)

7AM – 11 AM EST (US session)

Pairs

I have tested: EURUSD, GBPUSD, USDCAD, EURJPY, GBP/JPY.

Timeframe (TF)

5M Timeframe

15M Timeframe (recommended)

Buy signal

When v10 show blue color

When QQE is above 50 line

When CCI period 63 is above 0 line above +75 or above give safer signal

When the price is above 50 SMA.

And price is above the upper white line and the slope points up

Always wait until candle close and then place your order 5-7 pips above last closed

candle.

Stop Loss. I use 50sma as SL. So if price close below the 50 sma I close the trade.

See PIC.1

Sell signal

WHEN lcd v10 show yellow colour.

When QQE is below 50 line

When CCI period 63 is below 0 line -75 or below give safer signal

When the price is below 50 SMA.

And price is below the lowest white line and the slope points down.

Always wait until candle close and then place your order 5-7 pips below last closed

candle.

Stop Loss. I use 50sma as SL. So if price close above the 50 sma I close the trade.

See pic.2 and pic 2A

PIC 2A

WHEN lcd v10 show yellow colour.

When QQE is below 50 line

When CCI period 63 is below 0 line -75 or below give safer signal

When the price is below 50 SMA.

And price is below the lowest white line and the slope points down.

Always wait until candle close and then place your order 5-7 pips below last closed

candle.

Stop Loss. I use 50sma as SL. So if price close above the 50 sma I close the trade.

See pic.2 and pic 2A

PIC 2A

My daily routine before I start trading.

First I start to look at the 1our timeframe. Just to get an overview. Start to look from left

and go to right. It will give you a view about what is going on. Is it

uptrend/downtrend/ranging.

See pic. 3

First I start to look at the 1our timeframe. Just to get an overview. Start to look from left

and go to right. It will give you a view about what is going on. Is it

uptrend/downtrend/ranging.

See pic. 3

Here you see we have had a huge down move. Then a bit up and then again down. The

last couple of days we see almost ranging. So it give you an Idea that until EURJPY is

ready for a new long-term trend we can expect to go up/down up down. Its ok but it gives

us a clue about what to expect. If you look it seem like the overall bias is still down.

After that overview I go into 15M timeframe and put in some SR line (support-Resistance)

It just to give me some levels where price maybe will turn or respect the lines. We really

don’t know what will happen but for me its nice to see what price has done let’s say

yesterday, because it can give me some levels to look for..

see pic. 3 and 4

last couple of days we see almost ranging. So it give you an Idea that until EURJPY is

ready for a new long-term trend we can expect to go up/down up down. Its ok but it gives

us a clue about what to expect. If you look it seem like the overall bias is still down.

After that overview I go into 15M timeframe and put in some SR line (support-Resistance)

It just to give me some levels where price maybe will turn or respect the lines. We really

don’t know what will happen but for me its nice to see what price has done let’s say

yesterday, because it can give me some levels to look for..

see pic. 3 and 4

Just look at the red lines I put in. It just levels where price found support and resistance.

They are drawn on a 15 min timeframe from Thursday 20 Nov 2008.

See how price have reacted from the lines we draw on 15 mins chart from Thursday. And

now we see how price have reacted on a 5 mins timeframe on Friday,

And remember when a support or Resistance level is broken then it change.

That means if a level have reacted earlier as support and then later get broken. Then next

time price is close to that price or touch it then it will react often as resistance. See chart

above.

Daily goal and money management.

I have a daily goal that I want to make 5% profit every day.

That means I can double my money every 15 day.

Yes you right every 15 day. SO IF IT TAKE 20-25 DAY, TO DUBBLE YOUR MONEY ITS

OK IS´N IT.

And I only risk a max of 2% of my money in any trade I take.

Let’s say you have an account with 1000$ it means you can risk max 20$ on any trade you

open

If you trade 1minilot you can take a risk of 20 pips.

If you think its too small SL then you need to lower your lot size and trade micro lots.

VSA (Volume spread analyzing)

VSA is a theory about how we better can see how the smart money behaves along the

trading day.

If we learn more about reading volume and compare it to the closed candle we time by

time can see what the smart money is doing.

And if we can trade in harmony with the smart money it will give us better chances to trade

in profit.

But it’s a diff. Stuff to explain in short, so below is a link where you can download an

EBOOK about VSA.

They are drawn on a 15 min timeframe from Thursday 20 Nov 2008.

See how price have reacted from the lines we draw on 15 mins chart from Thursday. And

now we see how price have reacted on a 5 mins timeframe on Friday,

And remember when a support or Resistance level is broken then it change.

That means if a level have reacted earlier as support and then later get broken. Then next

time price is close to that price or touch it then it will react often as resistance. See chart

above.

Daily goal and money management.

I have a daily goal that I want to make 5% profit every day.

That means I can double my money every 15 day.

Yes you right every 15 day. SO IF IT TAKE 20-25 DAY, TO DUBBLE YOUR MONEY ITS

OK IS´N IT.

And I only risk a max of 2% of my money in any trade I take.

Let’s say you have an account with 1000$ it means you can risk max 20$ on any trade you

open

If you trade 1minilot you can take a risk of 20 pips.

If you think its too small SL then you need to lower your lot size and trade micro lots.

VSA (Volume spread analyzing)

VSA is a theory about how we better can see how the smart money behaves along the

trading day.

If we learn more about reading volume and compare it to the closed candle we time by

time can see what the smart money is doing.

And if we can trade in harmony with the smart money it will give us better chances to trade

in profit.

But it’s a diff. Stuff to explain in short, so below is a link where you can download an

EBOOK about VSA.